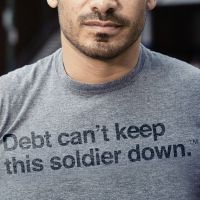

Five Steps to a New Financial You in 2017

Holiday shoppers have been careful each holiday season to make their lists and check them twice. Budgets have become more discerning, and savers have become better planners for their holiday spending, prioritizing savings along the way.