"Get Paid Daily" Sounds Great-But Is It Costing You More Than You Think?

Earned wage access services, which allow workers to get their paychecks early, often end up costing more than people realize and can trap users in a difficult cycle.

Manage Your Debt - Let's Explore Your Options

GET STARTED NOW

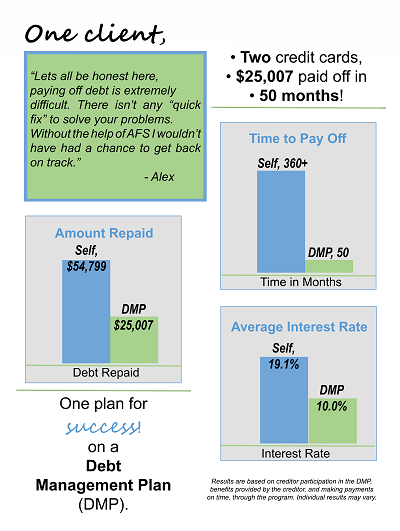

If you're falling behind in your creditor payments and receiving collection calls, a debt management plan might be a good option for you. American Financial Solutions offers financial education and credit counseling services for consumers in need of assistance. Learn how a properly structured debt management plan could be your way out of debt.

Debt management plans are tools that help those struggling with credit cards, medical bills, and other balances. This custom-tailored plan provides a clear pathway toward debt freedom. It may also include other financial strategies to help set you up for future success.

American Financial Solutions proudly offers debt management plans that consolidate loans and credit cards. Under a debt management plan, we will:

It all begins with a phone call to our non-profit credit counseling agency. During this confidential conversation, a credit counselor will gain a full understanding of your financial situation. Then, we'll consolidate your bills into an affordable payment. You pay us, we pay your creditors, and you get closer to becoming debt free. A typical plan lasts three to five years.

American Financial Solutions is not a debt consolidation company. We will never ask you to take out a new loan to consolidate your debt. For some, this can lead to a difficult financial situation if they can’t make the higher payments required for the new loan.

Instead, we educate and advise our clients to help them make financial choices that lead to long-term, positive results. Learn more about us and how we can help.

A seasoned professional can help you determine if a debt management plan is the right choice. If not, they can recommend other methods that may work better. Some people don't need to enroll in a debt management plan – they simply follow an action plan outlined by their counselor.

The credit counselors at American Financial Solutions are well-versed in debt repayment. Our recommendations are backed by years of experience helping thousands of people get back on track.

A debt management plan does more than help you reach your goals. It's also a powerful tool that helps set you up for better decision-making and future success. Some of the benefits of having a carefully designed debt management plan include:

Many people find that developing a straightforward, fixed plan to tackle their debt takes some of the burden off their shoulders. They can feel more confident in their future and significantly reduce the anxiety associated with unmanageable debt.

An American Financial Solutions credit counselor is also an invaluable resource you can turn to for questions and guidance along the way. Knowing that someone is by your side and can listen with a compassionate ear makes all the difference.

Weighing the pros and cons of any debt relief option is part of the process. In doing so, you can arrive at a solution that works best for your situation. Some things to consider about debt management plans include:

In a few simple steps, you can enroll in a debt management plan that supports your financial needs. American Financial Solutions is committed to your success and guiding you at every turn of this process.

Enroll in a debt management program with our credit counseling agency by following these steps:

Debt and credit counseling services are available from our certified credit counselors. We'll review your financial situation and help you prepare a detailed budget that includes all your income, expenses, and debt.

Once your credit counselor has gathered as much information as possible about your current situation, we'll develop an action plan to help you reach your financial goals. This may encompass several available solutions, such as:

If a debt management plan is part of your newfound approach, we'll ensure it works within your budget. Best of all, we'll consolidate all your debt into just one manageable monthly payment that's due on the day of your choice.

We pride ourselves on our excellent customer service and the relationships our credit counselors develop with their clients. Our credit counseling services are available at your convenience. You may also access your account online 24/7 via our website and secure client login.

Creating a debt management plan is a positive step forward. The critical thing to find out is whether this is the right option for you. Work with a compassionate, knowledgeable credit counseling agency to learn more about debt management services and other solutions.

Your debt management plan could be the first step toward financial freedom. American Financial Solutions also provides educational tools to help you plan and prevent credit problems in the future.

American Financial Solutions is a registered, 501(c) 3 non-profit agency part of the North Seattle Community College Foundation. We're a proud member in good standing with Better Business Bureau (BBB). Our organization is accredited by Council on Accreditation and National Foundation for Credit Counseling (NFCC).

Don't wait – contact us to review your debt with a certified credit counselor. You can also complete our online application to get started today.

Browse our recent blog articles and you will see and learn about the various ways AFS can help you, as well as educate yourself.

Earned wage access services, which allow workers to get their paychecks early, often end up costing more than people realize and can trap users in a difficult cycle.

Learn what truly impacts your credit score in 2026 — including payment history, utilization, medical debt changes, rent reporting, and new credit trends.

Discover five simple financial habits that build long-term stability, reduce stress, and strengthen financial confidence — even on a tight budget. Practical tips anyone can start today.

Learn how to spot scams in 2026, including AI voice fraud, spoofed caller ID, fake loan offers, student loan scams, and tips to protect your money and identity.

Call us at (888) 864-8548

and your counselor will review your credit report, analyze your financial situation and help you find the option that's best for you.