Credit scores seem like one of the biggest mysteries of the credit world. Each credit bureau has their own credit score model, as well as different models used for mortgage lending and auto lending. All of these different credit score models can lead to extreme confusion on the part of the consumer trying to understand what their credit score means.

What does a Credit Score mean?

Your credit score is the numerical value of the risk that you will not repay your debts on time. The higher your credit score, the more likely you are to repay your debts as agreed. Of course if you have a lower score, the lender assumes you are less like to pay your debts on time.

How is a Credit Score Determined?

Unfortunately, if you have had a hardship and been unable to pay your bills on time, the credit score does not consider the life events that lead to the missed payments - it only analyzes the information in your credit report. However, there are many factors that make up a credit score.

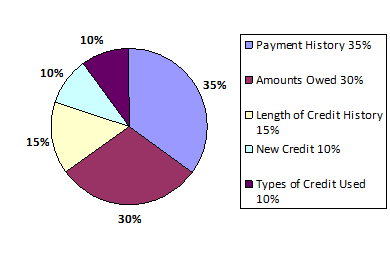

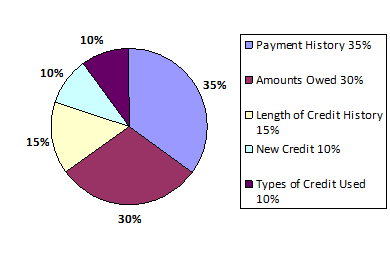

The biggest impact to your credit score is your payment history – do you pay your bills on time? If you are never late and always pay at least the minimum payment required, this will reflect well for your credit score. Payments that arrive more than 30 days late have a negative impact on your credit score. Accounts that have been sent to an outside collection agency also reflect poorly on your credit report and your credit score.

The next largest impact on your credit score is the amount of debt you owe. This is not just any debt. The debt that contributes the most to your score is credit card debt. The rule of thumb is that you never want to owe more than 30% of the available credit limit on a credit card. So, for instance, if your credit card limit is $1,000, the most you would want to have on that card is $300. If you charged more than that and it was reported on your credit report, it could negatively impact your credit score.

Yes, other types of debt do count in that 30% ratio, but credit cards receive the most weight because they are unsecured debt. Credit card companies recognize that if someone has to make a choice between paying their car loan or a mortgage and paying their credit card, the secured loans typically take priority.

About 15% of your credit score is the length of time you have been using credit. This section takes into consideration how long you have been using specific types of credit. As long as your payment history is good, the score can take into account all of your loans going back to when you opened your first credit account. If you have negative payment marks on your credit report, they can only be reported for seven years. Positive payment information can be reported on your credit report forever.

A small percentage of your credit score is also determined by the new credit you may have established. It considers how many inquiries (applications for credit) you have completed in the last 24 months, as well as the number of credit accounts you did open and the type of those accounts (credit cards, mortgage, auto loan, etc.). Also, the proportion of accounts on your credit report that were opened in the last 24 months compared to the number of accounts that have been open longer, is considered.

Finally, the credit score looks at what types of credit you are using. The idea is to have a mix of secured (mortgage and car) and unsecured debt. This does not mean you need to have every type of debt, but you should have more than one type in order to have the best credit score.

Below are some figures from MyFICO.com, an industry leader in credit scores.

If you have not received a free copy of your credit report in the last 12 months, visit www.annualcreditreport.com and order yours today. The credit report is free, but you can pay ($10) to have the credit score added on. Annual Credit Report is the only legitimate place to receive your free credit report. You may get your credit report directly, from all three credit bureaus (Equifax, Experian, and TransUnion) for a fee.

Remember, your credit score and credit report make up a snap shot of where you are, financially, right now. It is not a permanent situation. If you need help understanding your report or your credit score, or need help developing a plan for managing your debts, contact a certified credit counselor today at American Financial Solutions, a non-profit credit counseling agency.