Manage Your Debt - Let's Explore Your Options

GET STARTED NOWProtecting Your Identity In the Digital Age

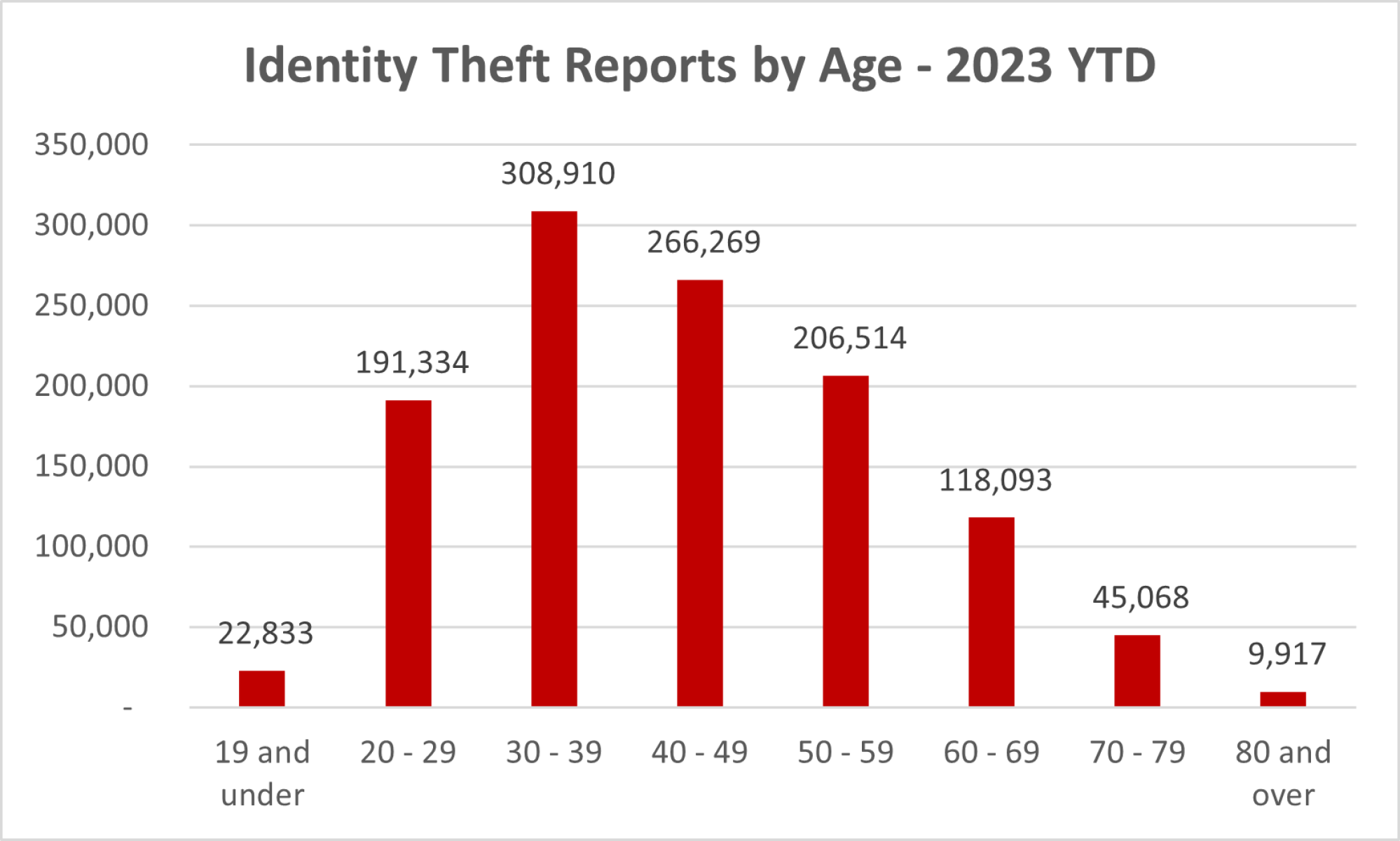

Last year, the Federal Trade Commission received 5.7 million reports of fraud and identity theft. There is a case of identity theft occurring every 22 seconds in the United States and people aged 30 – 39 were the most victimized (IdentityTheft.org, 2023).

While these statistics are unnerving, there are many ways to cut down on how criminals access our information. We must be proactive in protecting our personal data and below, we outline a few of those ways, with some information from the Federal Trade Commission.

How To Get Less Mail From Marketers

To decide what types of mail you do and don’t want from marketers, register at the Direct Marketing Association’s (DMA) consumer website DMAchoice.org, and choose what catalogs, magazine offers, and other mail you want to get. DMAchoice will stop most, but not all, promotional mail. You’ll have to pay a $4 processing fee, and your registration will last for 10 years.

If you do not have online access, register by sending your name and address (with signature), along with a $5 processing fee (check or money order payable to the Association of National Advertisers or ANA) to:

DMAchoice

Consumer Preferences

P.O. Box 900

Cos Cob, CT 06807

The site also offers the no-cost option to stop mail from being sent to someone who’s deceased or to a dependent in your care. Registration for the Caretakers List will last for 10 years.

DMAchoice.org also has an Email Preference Service that lets you get less unsolicited commercial email. Registration is free and will last for six years. To learn more about what options you have for dealing with unwanted email, read this article from the Federal Trade Commission on email spam.

How To Stop Credit Card and Insurance Offers

If you don't want to get prescreened offers of credit and insurance in the mail, you have two choices for opting out of those offers:

- Opt out of getting them for five years.

- Opt out of getting them permanently.

To opt out for five years: Go to optoutprescreen.com or call 1-888-5-OPT-OUT (1-888-567-8688). The phone number and website are operated by the major credit bureaus, Equifax, Experian, TransUnion and Innovis.

To opt out permanently: Go to optoutprescreen.com or call 1-888-5-OPT-OUT (1-888-567-8688) to start the process. But to complete your request, you’ll need to sign and return the Permanent Opt-Out Election form you’ll get after you’ve started the process.

When you call or visit optoutprescreen.com, they’ll ask for your personal information, including your name, address, Social Security number, and date of birth. Sharing your Social Security number and date of birth is optional, but the website says that giving this information can help them ensure that they can successfully process your request. It says the information you give is confidential and will be used only to process your request to opt out.

How to Place a Credit Freezes or Fraud Alert

Credit freezes and fraud alerts can protect you from identity theft or prevent further misuse of your personal information if it was stolen. Learn what they do and how to place them.

Credit Freezes

- Who can place one: Anyone can freeze their credit report, even if their identity has not been stolen.

- What it does: A credit freeze restricts access to your credit report, which means you — or others — won’t be able to open a new credit account while the freeze is in place. You can temporarily lift the credit freeze if you need to apply for new credit. When the freeze is in place, you will still be able to do things like apply for a job, rent an apartment, or buy insurance without lifting or removing it.

- Duration: A credit freeze lasts until you remove it.

- Cost: Free

- How to place: Contact each of the three credit bureaus — Equifax, Experian, and TransUnion.

Fraud Alerts

- Who can place one: Anyone who suspects fraud can place a fraud alert on their credit report.

- What it does: A fraud alert will make it harder for someone to open a new credit account in your name. A business must verify your identity before it issues new credit in your name.

- When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus.

- Duration: A fraud alert lasts one year. After a year, you can renew it.

- Cost: Free

- How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion. You don’t have to contact all three. The credit bureau you contact must tell the other two to place a fraud alert on your credit report.

Extended Fraud Alert

- Who can place one: An extended fraud alert is only available to people who have had their identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report.

- What it does: Like a fraud alert, an extended fraud alert will make it harder for someone to open a new credit account in your name. A business must contact you before it issues new credit in your name.

- When you place an extended fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus twice within one year from when you place the alert, which means you could review your credit report six times in a year.

- In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for five years, unless you ask them not to.

- Duration: An extended fraud alert lasts seven years.

- Cost: Free

- How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion. You don’t have to contact all three. The credit bureau you contact must tell the other two to place an extended fraud alert on your credit report.

| Which Alert is Right For Me? | ||

| Fraud Alert | Extended Fraud Alert | Credit Freeze |

| Place when you’re concerned about identity theft. It makes it harder for someone to open a new credit account in your name. It’s free and lasts 1 year. | Place when you’ve had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. It’s free and lasts 7 years. | Place a credit freeze if you know someone has stolen your identity or you've been told that your personal identifying information has been compromised. This includes if you suspect someone has stolen your social security number and date of birth which can be used to open credit in your name. You may also want to place a credit freeze if you want to be especially cautious when it comes to your credit files. |

| Equifax | Experian | TransUnion |

| 800-685-1111 | 888-397-3742 | 888-909-8872 |

Final Tips for Safety

- Opt-out of prescreened credit and loan offers.

- Use anti-virus protection software on your computer and cell phone.

- Consider using a password manager which is a software application that stores and manages passwords for your various accounts.

- Evaluate your need for a Virtual Private Network (VPN). A VPN works by creating a secure, encrypted connection between your device and the remote service (website and other services) so that your data moves in privacy.

- Protect your social security number.

- Check your credit report, regularly.

- Sign up for alerts from your bank, credit card company, benefit cards, etc.

- Shred all documents containing your personal or credit card information.

- Sign up for the “Do Not Call” list (1-888-382-1222) and take yourself off multiple mailing lists.

- Use direct deposit.

- Do not give ANY personal information over the phone unless you initiated the call.

- Be skeptical of all unsolicited offers.

- Protect children’s information like you would your own.

To learn more about protecting your privacy or if you have been a victim of a scam, reach out to the Federal Trade Commission. There you can report fraud or scamming activity and learn the steps to take if you have had your information compromised.

Published Aug 7, 2023.