Manage Your Debt - Let's Explore Your Options

GET STARTED NOWPay Off Your Mortgage Early and Easily

| Loan Details | |

| Amount | $300,000 |

| Interest rate | 3.500% |

| Length of loan | 30 years |

| Standard Payment | $1,347.13 |

| Additional Payment | $112.50 |

| Standard Loan | Loan with Additional Payment | Savings | |

| Monthly Payment | $1,347.13 | 1347.13+ 112.50 = $1,459.38 | - |

| Total Monthly payments | $484,964.35 | $458,602.23 | $26,362.12 |

| 360 months (30 years) | 315 months (26 years, 3 months) | 3 years, 9 months |

When it comes to a home mortgage loan, you can pay off the loan much more quickly and save a great deal of money by simply paying a little extra each month.

For example, what you see here is someone who has taken out a 30-year loan for $300,000.00 with a 3.500% interest rate. Their monthly payment (interest and principal only) will be $1,347.13. By the time the 30-year time is complete, they will have paid $484,964.35 for their home.

If they pay just $112.25 more each month (which equals, one extra payment a year), they will save $26,362.12 in interest! In addition, they will pay the loan off 3 years and 9 months sooner than if they only paid the regular monthly payment.

In this example, the $300,000 borrowed is the loan principal. The interest rate is 3.500% and the standard term is 30 years or 360 payments.

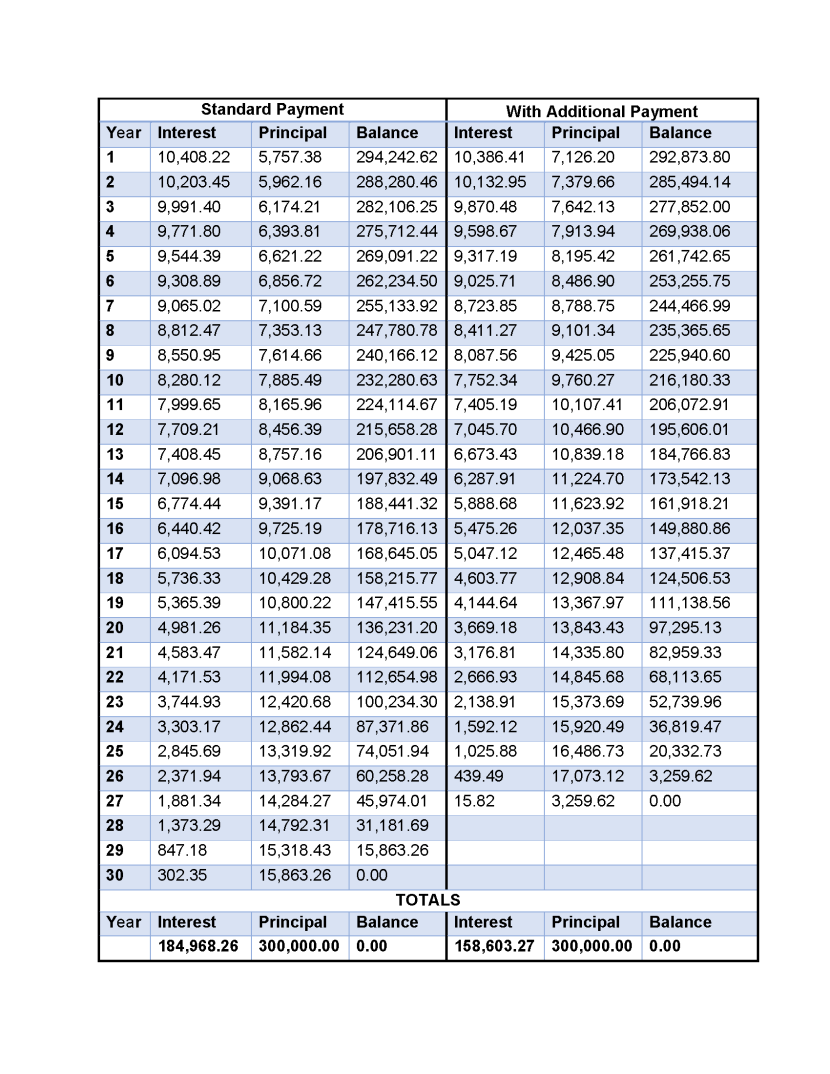

You can view the amortization schedule for each of these loan repayments, below. The amortization table is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term. Each periodic payment is the same amount in total for each period.

Published Jan 20, 2022.