Manage Your Debt - Let's Explore Your Options

GET STARTED NOWLife After Debt: Building Habits That Keep You Moving Forward

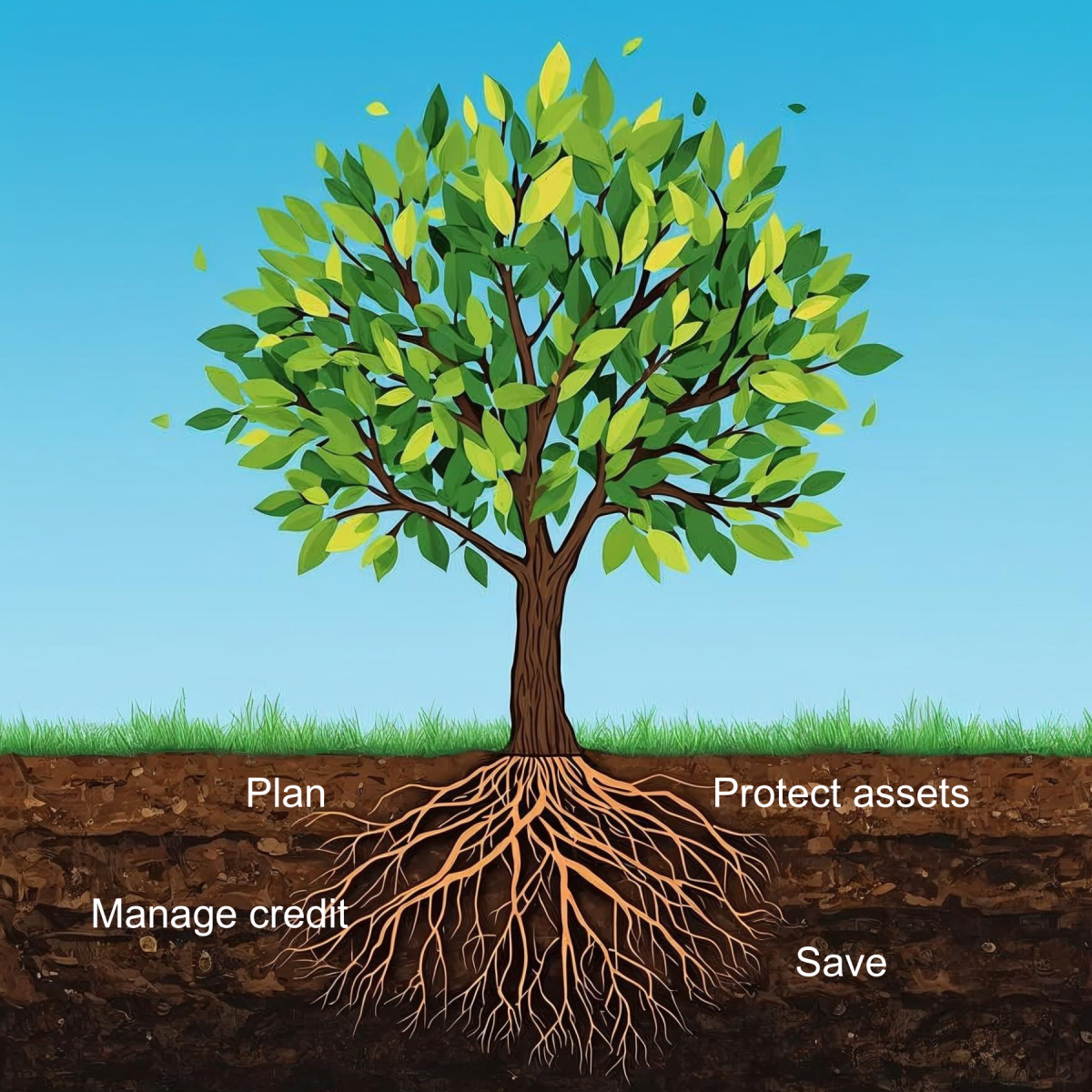

Getting out of debt isn’t just about paying off balances. It’s about building a new relationship with money — one that supports your goals, protects you from setbacks, and helps you feel confident about the future.

Taking steps to tackle your debt is already a huge achievement. You’ve created a plan, you’re making progress, and you’ve proven that change is possible. Now it’s about building the habits that will keep you moving forward long after the debt is behind you.

Why Habits Matter

Debt often creeps up when daily money habits don’t align with our long-term goals. Maybe expenses weren’t tracked closely, emergencies forced reliance on credit cards, or spending provided a temporary stress relief.

Habits are powerful because they work quietly in the background. When you build strong money routines, you don’t have to rely on constant willpower — the system carries you.

Financial Habits That Stick

1. Create a Spending Plan You Can Actually Live With

Forget the word “budget” if it feels restrictive. Instead, think of it as a spending plan: a roadmap for how you want your money to work for you.

- Start with your fixed expenses (housing, transportation, utilities).

- Add in savings and debt payments.

- Then allow yourself guilt-free money for things you enjoy.

The goal isn’t perfection; it’s awareness. Even tracking your spending for 30 days can reveal patterns you didn’t notice before.

2. Build Sinking Funds for Known Expenses

Holidays, car repairs, back-to-school costs — these aren’t surprises, yet they often catch people off guard. That’s where sinking funds come in. A sinking fund is simply money you set aside little by little for an expense you know is coming, like a mini savings account with a specific purpose.

By setting aside a small amount each month into these savings “buckets,” you’ll have cash ready when those moments arrive. No more reaching for credit cards.

3. Automate Where You Can

Automation is one of the best tools for stability. Set up automatic transfers for:

- Savings deposits.

- Regular bills.

- Your DMP payments (if not already automated).

This ensures your priorities are handled first, and it reduces the stress of remembering every due date.

4. Build a Starter Emergency Fund

Even while on a DMP, try to build a small cushion — $500 to $1,000. This doesn’t have to happen overnight. Start with $10 or $20 at a time. The goal isn’t to build the “perfect” six-month fund right away, but to create a safety net so you don’t fall back on credit cards when life happens.

5. Pause Before Big Purchases

Use the 24-hour rule: if you see something you want, wait a day before buying it. Most of the time, the urge passes. If it doesn’t, you’ll know it’s something you actually value — and can plan for.

Encouragement for the Journey

Financial habits are like muscles. At first, building them feels uncomfortable and requires extra effort. But the more you practice, the stronger they get — until they’re second nature.

And here’s the best part: you don’t have to be perfect. Even small improvements add up. Every time you choose to put $20 into savings instead of spending it, you’re proving to yourself that you can handle money differently. Every time you pause before a purchase, you’re creating space between your money and old habits.

Final Thought

Your DMP is helping you get out of debt, but the habits you build now will keep you out of debt in the future. Think of it as writing a new story — one where money supports your life instead of holding you back.

You’ve already taken the hardest step by starting this journey, and every new habit you practice is another step forward. Building habits takes time, but you don’t have to do it alone — our counselors are here to support you and help you create a plan that works for your life.

Published Aug 25, 2025.