Manage Your Debt - Let's Explore Your Options

GET STARTED NOWAm I Being Scammed? How to Spot Fraud Before It Costs You Money

If you’ve ever paused before clicking a link or answering a phone call and wondered, “Is this real?” — you’re not alone. Searches for loan scams, debt relief scams, student loan scams, and financial fraud have skyrocketed in the last two years. According to recent alerts from the Federal Trade Commission (FTC), scam activity is growing in both volume and sophistication:

Scammers now use polished websites, AI-generated voices, spoofed phone numbers, and fake customer service messages to trick consumers into acting fast.

In 2026, the scams look different — but the red flags are the same. Here’s how to protect yourself (and your loved ones) from the tricks that catch people every day.

1. They Create Urgency — “Do This Now or Else”

Scammers rely on stress, pressure, and fear.

The FTC article, How to Avoid Scams, reports that scammers often demand action within minutes. Common urgent lines include:

- “We approved your loan — but you must act now.”

- “If you don’t respond now, you will lose the discount on your current bill.”

- “Your account will be closed in 24 hours unless you verify your identity.”

- “We can erase your student loans today only.”

Real organizations don’t pressure you to act instantly.

If someone is pushing urgency, pause.

2. They Ask for Money Up Front

If someone says:

- “Pay us before your loan is released,”

- “Send a deposit to unlock funds,” or

- “Buy gift cards to avoid arrest,”

- It’s a scam. Every single time.

The FTC has a full guide explaining illegal advance-fee loan scams

Legitimate lenders never require payment to receive a loan.

3. The Offer Sounds Too Good to Be True

If someone guarantees:

- Loan approval

- Full credit repair

- Instant debt forgiveness

- Student loan cancellation

- It's not legitimate.

The Consumer Financial Protection Bureau (CFPB) warns that many “guaranteed” student loan or debt relief programs are actually scams. Real programs never require “processing fees” or “expedited forgiveness charges.”

4. They Pretend to Be Someone You Trust

One of the fastest-growing types of fraud is imposter scams, according to the FTC:

https://consumer.ftc.gov/articles/how-avoid-scam

Scammers pretend to be:

- Banks

- The IRS

- Credit card companies

- Cable companies

- Amazon

- Government agencies

- Even your family (especially via text, spoofed numbers, or AI voice cloning)

The Federal Communications Commission (FCC) warns that scammers now use AI voice cloning to imitate a loved one’s voice with shocking accuracy. They also use Caller ID spoofing to make phone numbers appear legitimate.

Always verify by calling the organization or person on a known number. This could be one you look up on your statement or directly at the company’s website.

5. They Ask for Personal Information

Scammers may ask for:

- Social Security numbers

- Bank account info

- Verification codes sent to your phone

- Photos of your ID

- Passwords or PINs

No legitimate organization will ever ask for your password or PIN. If someone requests sensitive info before you even apply, walk away.

6. They Ask You to Pay in Unusual Ways

Common scam payment methods include:

• Gift cards

• Wire transfers

• Cash apps (Venmo, Cash App, Zelle)

• Cryptocurrency

• Prepaid debit cards

The FTC warns that these payments are often untraceable — exactly why scammers prefer them. Legitimate businesses typically don’t require these methods, especially for first-time or unexpected payments.

That said, many people do use apps like Zelle or Venmo for trusted situations — paying a regular caretaker, sending money to family, or even paying a contractor you’ve already vetted. The key is who you’re sending money to.

These tools should only be used when:

- You personally know the person or company, and

- You’ve confirmed they’re legitimate, reputable, and expecting your payment.

If you’re not sure who’s on the other end, don’t use instant-payment apps — once the money is gone, it’s nearly impossible to get it back.

7. The Website or Email Looks “Almost” Real

Today’s scam sites look more polished than ever.

Red flags include:

- Slight misspellings

- Generic email addresses

- No physical address

- No customer service contact

- Fake reviews or testimonials

- A URL that looks “off”

You can verify general government fraud information at USA.gov

And check suspicious businesses using the Better Business Bureau (BBB) Scam Tracker

New 2026 Scam Trends You Should Know

AI Voice Scams

Scammers use AI to mimic the voice of someone you know, often calling for “urgent help.”

FCC guidance: Always hang up and call the person back using a phone number you know.

Fake Student Loan Forgiveness Programs

The U.S. Department of Education warns of scams pretending to offer “instant” forgiveness. Official info only exists at StudentAid.gov

Social Media Investment Scams

The FTC reports a dramatic rise in scams involving:

- Crypto: Scammers may use fake cryptocurrency platforms or coins to lure people into investing money that disappears once they transfer funds.

- AI trading bots: Fraudsters promote “AI-powered” trading bots that promise guaranteed returns but are often rigged, nonfunctional, or designed to steal deposits.

- Fake “financial coaches”: Some scammers pose as financial coaches, offering high-priced advice or debt help with no credentials, no results, and no intention of providing real services.

- Influencer schemes: Influencers — or accounts pretending to be them — may push investment opportunities, giveaways, or partnerships that are actually scams designed to collect money or personal information.

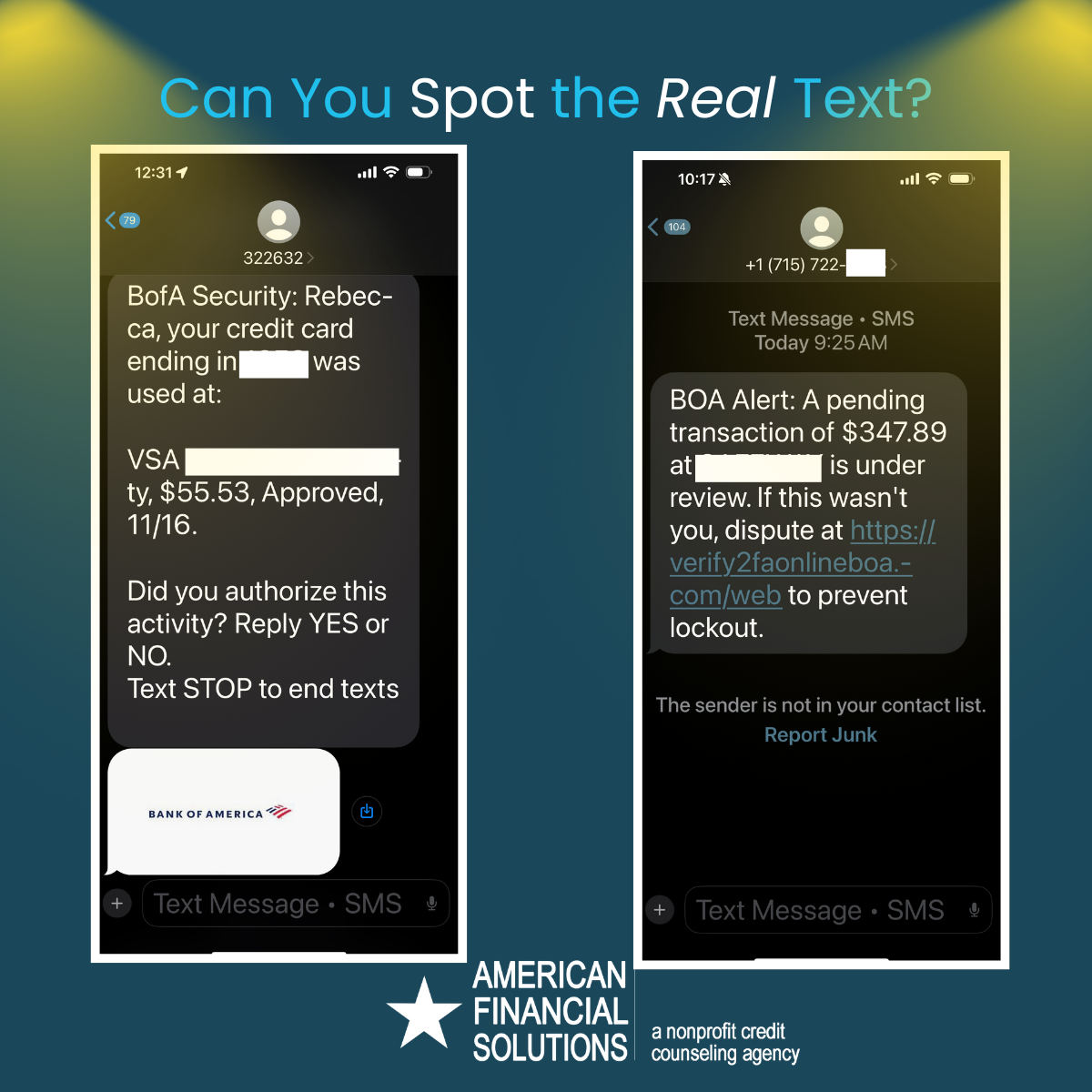

Fake Customer Support Messages

Scammers impersonate the following services, often via text message.

- Amazon

- Banks

- Utility companies (cable, internet, electric, etc.)

- Delivery companies

- Credit card providers

How to Protect Yourself in 2026

- Slow down before acting - Scammers rely on speed.

- Verify the source - Visit the company’s official website directly.

- Protect your info - Never give personal details to someone who contacts you first.

- Use government sites - For loans, student aid, benefits, and taxes.

- Talk it through - Scams often fall apart when you tell someone else.

If You’re Ever Unsure — Ask.

AFS is here to help you:

- Understand loan offers

- Avoid debt relief scams

- Understand student loan programs

- Protect your money and credit

In a world where scams are becoming more believable, taking a moment to double-check is one of the smartest financial decisions you can make.

Published Dec 3, 2025.