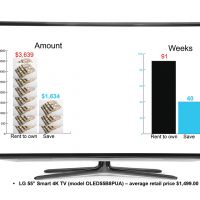

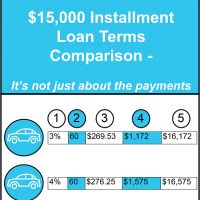

Making Successful Rent-to-Own Decisions

Renting to own is tempting when you need something now and you don't have the savings or cash to purchase it. There are alternatives and if you are going to rent-to-own, there are some questions you will want to ask yourself, first.