Why Pay Yourself First Might be Bad Advice

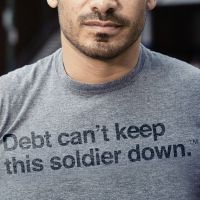

Pay yourself first. We have all heard the saying that is promoted as one of the tenants to sound financial management. It is true that having money in savings – a financial safety net – can mean the difference between surviving a financial emergency and digging deeper into debt. However, for some people it may be more beneficial to focus on saving after they meet their financial obligations.